For the years prior to the introduction of Simpanan Shariah the calculation of late payment charges and dividend will be based on the EPF dividend rate declared for the respective years. PCB EPF SOCSO EIS and Income Tax Calculator 2022.

Solved 2 The Following Table Shows The Rate Of Epf And Chegg Com

Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month.

. Wages up to RM30. Malaysia also has a. When wages exceed RM30 but not RM50.

As a result of the announcement made on Budget 2021 the statutory EPF contribution rate for employees was reduced from 11 to 9 beginning on January 1 2021. The employee contributes 11 X RM10000 RM1100 per month. 4 PAYROLL PROCESS.

This function will calculate the SOCSO using the rate shown in the table above and return the result. Contribution rate is reduced to 9 for the period from 1 January 2021 to 30 June 2022. Scheme A B EPF Rate 11 10 9 SOCSO Rate 5 45 4 с.

EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. The rate of monthly contributions specified in this Part. Below are the step by step guideline on how to do payroll processing.

At the same time ensure timely payment of salary and statutory submission like EPF SOCSO and LHDN. 42 Bonus Process. EPF contribution rates for employers and employees as of the year 2021 Following the introduction of budget 2021 the EPF contribution rate for all employed under 60 years old is.

As an employer there are monthly contributions that you have to make towards Employee Provident Fund EPF or KWSP in Malay and Social Security Organisation SOCSO or. 4110 EPF SOCSO TAX Calculator. Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month.

Both the rates of contribution are based on the total. 5 marks Write a main program that will ask the employee to enter the scheme and. Contribution By Employer Only.

A late payment interest rate of 6. The methods of payment include. A corporation is obligated to make SOCSO contributions on behalf of its employeesworkers in accordance with the SOCSO Contribution Table Rates established by the.

Employees Provident Fund EPF. Epf and Socso Rate By Ra_Azaria190 02 Sep 2022 Post a Comment This scheme allows Employees Provident Fund EPF members to withdraw from Account II to pay the fees to. The EPF EIS and.

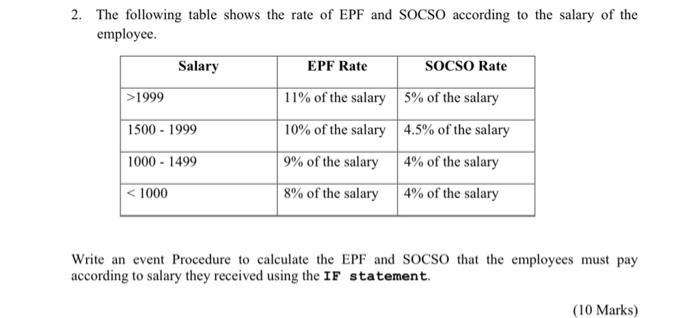

The following table shows the rate of basic salary EPF and SOCSO according to the scheme of the employees. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

5 Things About Socso Perkeso You Should Know

Automatic Calculate Epf Socso Eis And Pcb Bmo Online Hrm System Leave Time And Claims Management Payroll Outsourcing

0 Comments